In Belgium, you can use the classic BV company form for 2 purposes: as a working company or as a patrimony company. The latter is an interesting option for you as a Belgian investor, due to tax advantages as well as benefits in case of donation. In this article, we discuss why and how you can transform a working company into a patrimony company.

Difference between operating company and patrimony company?

An operating company focuses on carrying out an activity and performing work, with the shareholders also working within the company. In contrast, a patrimony company focuses on investing or investing existing assets and the shareholders are not actively involved in the activities of the company. A patrimony company thus serves merely to manage an existing asset. As a Belgian investor, it is important to know how these different companies operate and consider the benefits of a possible conversion to a patrimony company. It is important to know that a patrimony company is not a separate type of company, but can take any existing company form. Investors usually opt for a commV, BV or NV.

Advantages of conversion to patrimony company

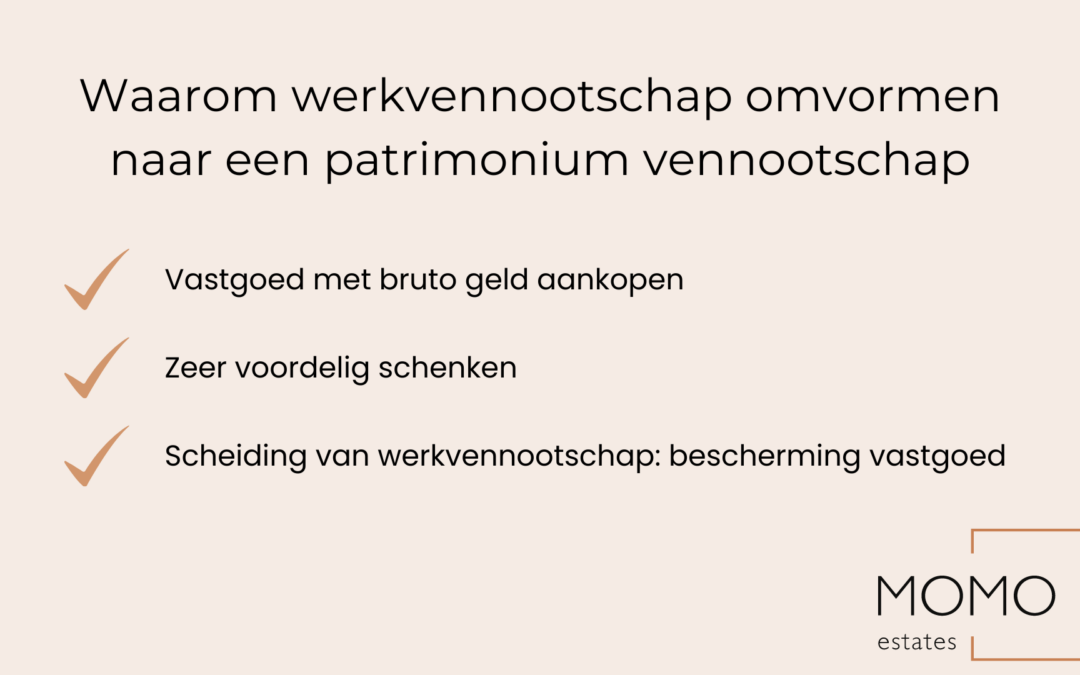

The main advantages for investors choosing a patrimonial company are:

- Tax benefits: The tax deduction on mortgage loans is full, unlike individuals who can only take a flat-rate deduction on their only own home. Other expenses such as insurance, maintenance costs and registration fees are also tax deductible and the property is fully depreciable.

- Gift of shares: Shares in a patrimony company can be gifted to heirs, avoiding high inheritance tax and applying the advantageous "flat" rate of 3%.

- Shielding the operating company: a patrimony company is usually set up by managers who already have an operating company and want to invest in real estate. This allows you to keep both companies separate, which ensures security in case of e.g. a possible bankruptcy of the operating company. An additional advantage is that if you stop your work activities, you can sell your work company and keep the patrimony company.

Steps for conversion to patrimony company

To transform from a working company to a patrimony company, the following steps need to be taken.

- Drafting of articles of association: It is necessary to draft and register new articles of association indicating that the company functions as a patrimony company.

- Registration: After drafting the new articles of association, it must be registered with the Belgian Chamber of Commerce.

- Tax implications: It is important to consider the tax implications of the conversion, such as changes in tax deductions and determining the tax value of the property. It is advisable to engage a tax expert to fully understand and assess the tax implications of the conversion.

Please note: These steps are general indications and may vary depending on the company's specific situation and legislation. It is therefore advisable to seek legal advice before starting the conversion.

Purchase & sale of property with a patrimony company

The purchase process of real estate through an asset company is identical to that of a sale between private individuals. The notarial deed must be signed after the shareholders of the patrimony company agree on the sale price and sign the compromise.

The patrimony company naturally needs money to finance the property. Since an operating company often exists alongside it, the latter usually "feeds" the former. Then, the patrimony company invoices some services or pays a management fee to the operating company.

At best, the patrimony company can support itself, for instance with the rental income from the properties it manages. You can also contribute your own funds to the patrimony company if you have no other business. This can stand perfectly well on its own; there is no need for an operating company.

To sell property, you can sell the shares of a patrimony company instead of the property itself. Then a new shareholder joins the patrimony company and the transferred property actually changes hands. The big advantage is that there are no registration fees and no gift tax is levied on the shares in case of a gift.

Conclusion

Investing with a patrimony company is especially interesting if you plan to build up an asset in the (very) long term with several properties or other investments.

To get maximum returns on your property investment, it is best to opt for high rental yields. With MOMO Estates, we specialise in such properties.

So you can get into Terneuzen, Netherlands with an investment of €250000 generate a rental income of €1250 per month, which is about 6% is.

MOMO estates will be happy to help you find out how an investment abroad can also be interesting for your investment portfolio. Would you like more information? Contact us!