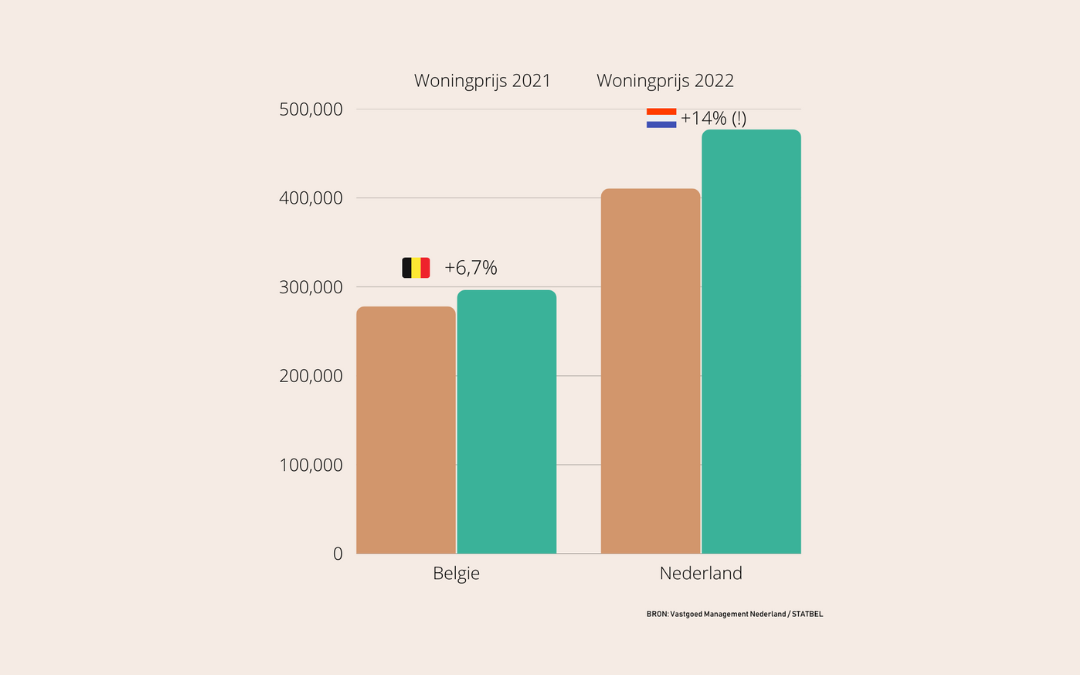

There seems to be no end to the turmoil in the Dutch housing market. This is not only reflected in the prices of owner-occupied houses at our northern neighbours but also the pricing of rental properties is rising to a record high in the Netherlands. It is precisely these high prices of rental properties that make investing in Dutch real estate even more interesting.

Rental house price rise in the Netherlands

The various studies done on the prices of rental properties in the Netherlands show the same picture. The rates per square metre of space in a rental house increased again by several percent in 2021 compared to the price used in 2020. Although the price rise may vary by region, it is generally referred to as the biggest price rise in three years.

Cause price rise in Dutch rental properties

An interaction of factors can be seen as the main cause of the rise in the price of Dutch rental housing. The basis lies in the relatively small supply of rental housing in the free sector combined with the problems in the owner-occupied housing market. The supply in owner-occupied houses in the Netherlands is too small to meet the high demand. As a result, most owner-occupied houses change hands for an amount far above the asking price. People frequently outbid each other in order to own a house. This makes it financially impossible for many families to buy a house.

The alternative to buying a house is, of course, to rent. However, a similar situation can be seen in the rental market. Indeed, many households earn too much to qualify for social housing. They have no other option to rent privately. In this sector, supply is very limited which naturally results in price increases. This trend is visible throughout the Netherlands only the impact differs by region. Rent prices in the big cities are obviously the highest but the trend described above can certainly also be seen in other regions such as Zeeuws-Vlaanderen.

Investment Dutch rental housing interesting due to price increases

The above presents opportunities for Belgian investors. The price increases make An investment in Dutch rental housing extra interesting. The main reason, of course, is that there is little chance of vacancy due to the too-small supply combined with the aforementioned fact that people do need to rent.

Are you interested in investing in Dutch rental properties? Then take a look at our offer in the Netherlands and feel free to contact us. Our advisers will be happy to inform you about your options in this respect.

Want to know more about the benefits of investing abroad with an experienced partner like MOMO estates? We are happy to advise you personally and fully tailored to your needs.