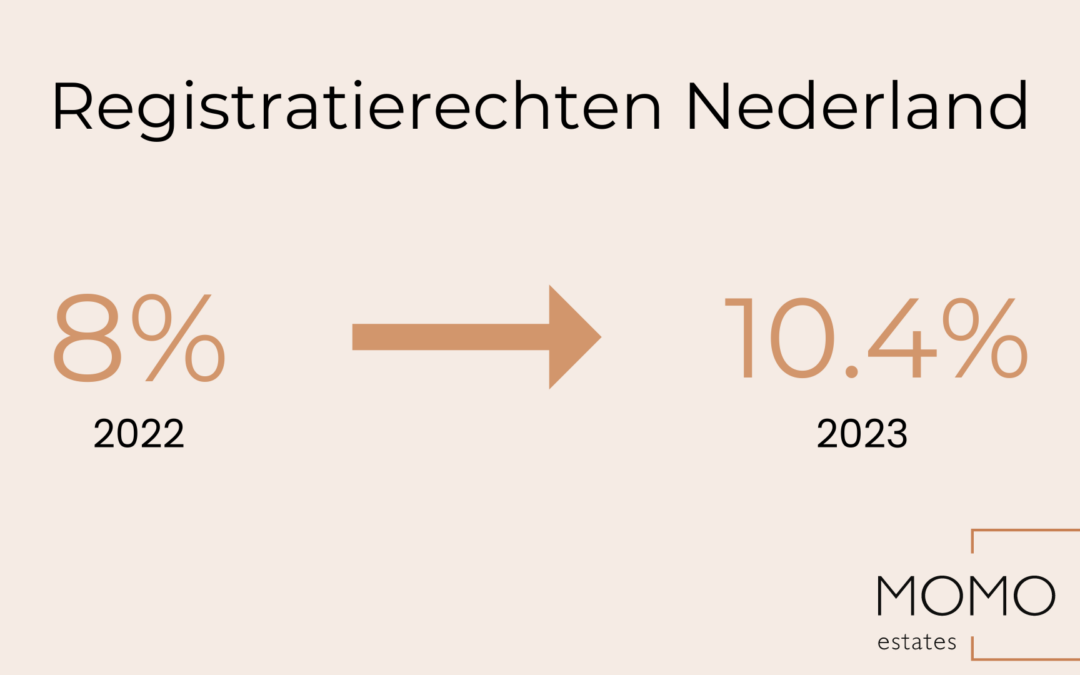

The Dutch housing market has been in turmoil for some time and the recent increase since 1 January 2023 of the registration fee from 8% to 10.4% is causing even more turmoil. So what does this mean for you as an investor?

Why are registration fees being increased in the Netherlands?

By increasing the registration fee from 8% to 10.4%, the Dutch government aims to improve the housing market and reduce wealth inequality. For instance, young homebuyers will not have to pay transfer tax once for the purchase of a house they will live in themselves. On the other hand, the government is raising the transfer tax rate for buyers who will not live in the house themselves, from 8% to 10.4%. Thus, the government wants to improve opportunities for first-time buyers and those moving on in the housing market.

What will change for you as a Belgian investor?

The benefit on purchase is now 2.4% lower than before, but the difference in registration fee or transfer tax still amounts to 1.6% with Belgium's 12%. Which on a €300,000 home can already save you a nice €4,800.

Is investing in Dutch real estate still interesting after the increase in registration fees?

The good news is that the Netherlands still offers an interesting investment opportunity compared to Belgium. Despite the 2.4% increase in registration duties, it is still interesting.

- In certain emerging regions, such as Terneuzen, the average purchase price is about 25% lower than in Belgium.

- What's more, you also often enjoy a double high return on your property investment, sometimes as high as 6%. So you can find properties worth €250,000 that can bring you €1,250 a month, unthinkable in Belgium.

Are you interested in a investment in Dutch property?

Then take a look at our offer and feel free to contact us for more information.

Our advisers are ready to advise you on the benefits of investing abroad and how we can support you in achieving your goals.