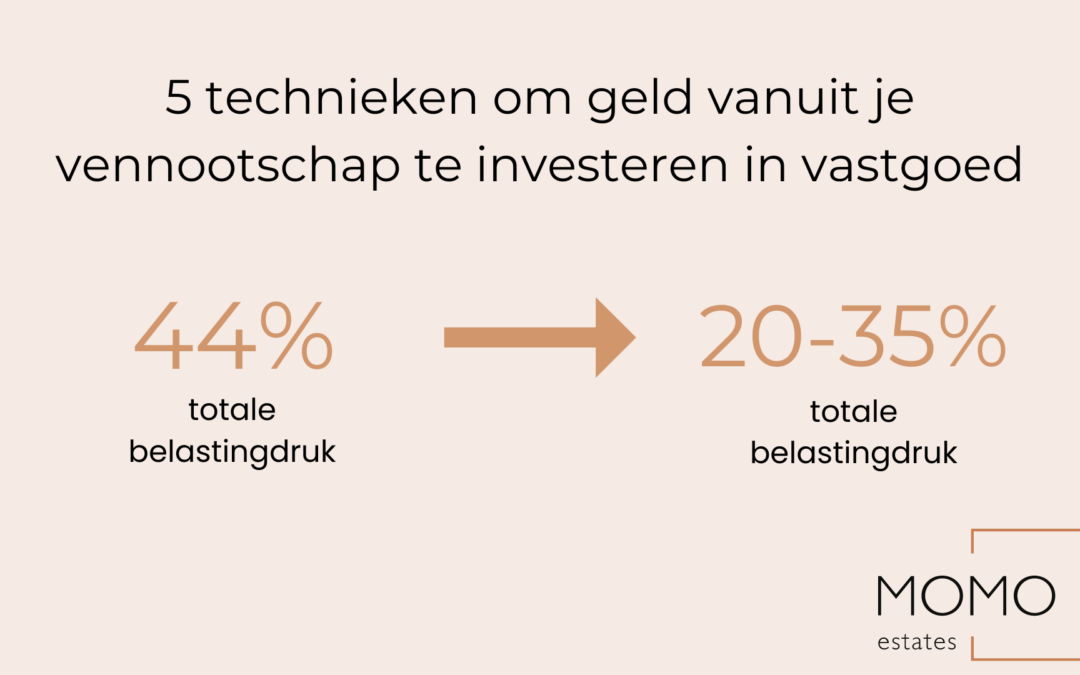

Corporate tax in Belgium is 25%, after which you still have to pay a dividend tax of 30%. This amounts to an average tax burden of 44%. There is another way, here we discuss 5 techniques you can use to get money out of your company to invest in real estate.

The 5 techniques we will discuss are:

- Paying dividends as a small company (VVPR BIS)

- Creation of liquidation reserve to invest in real estate

- PSPS to invest in real estate

- Warrants to invest in real estate

- Bullet loan to invest in real estate

1. Paying dividends as a small company (VVPR BIS)

This is a way to take money out of a company if you are still a small company. Thus, dividend VVPR BIS at only 15% withholding tax allows you to take your money out of the company from the 4th financial year. If you meet these conditions:

- On incorporation or capital increase, the company must be 'small'.

- Incorporation or capital increase took place after 30/6/2013

- This was done through a cash contribution (i.e. not contribution in kind).

- At the time dividends are granted under the VVPR bis scheme, the shares must be fully paid up.

2. Creation of liquidation reserve to invest in property

Are you not entitled to the reduced withholding tax (of 15% at VVPR BIS) when paying a dividend? And can you wait for 5 years? Then it is more advantageous to opt for a liquidation reserve.

The liquidation reserve is a way for small companies to pay dividends to shareholders at a lower tax rate. It can be created on the after-tax profit of a financial year with a separate charge of 10% corporate tax.

- After a five-year waiting period, the liquidation reserve can be distributed as a dividend with 5% withholding tax.

- If the distribution is deferred until the cessation of the company, no additional withholding tax is even paid.

The liquidation reserve conditions:

- For small companies only. There are limits on staff numbers, annual turnover and balance sheet.

- Booking should be done on separate accounts.

- Intangibility conditions. The money must remain in the account for a fixed period or be safely invested, e.g. in real estate. This is then an investment with your company in real estate.

3. PSPS to invest in real estate

A Free Supplementary Pension for the Self-Employed (PSPS) can be used in an advantageous way for the purchase, construction or renovation of property.

There are two ways to do this:

- taking an advance on the PSPS or by pledging the PSPS to a bank or insurer. In the case of an advance, one can borrow an amount from the VAPZ reserve, where interest has to be paid and the amount can be repaid later.

- In the case of a pledge, one can get a mortgage loan where the VAPZ premiums continue to be paid and the capital of the pension plan is used to repay the loan. However, interest has to be paid on the sum borrowed.

4. Warrants to invest in real estate

Warrants are financial instruments issued by a company or institution that give the acquirer the right to buy or sell shares at a predetermined price within a certain period of time.

There are two types of warrants: put and call. They can be used to take money out of a company and invest in property, but care should be taken to ensure that they may not be substituted for salary or already acquired benefits. There are tax advantages to using warrants, but it is advisable to consider the conditions and consequences beforehand.

5. Bullet loan to invest in real estate

A bullet loan or end-of-term loan is a mortgage loan with low monthly payments for individuals with capital in prospect or who do not want to use all their accumulated capital for this purpose.

This allows you to enter into a much larger investment with a limited amount of money. This method can yield returns as property values rise.

During the term of the bullet loan, you only pay interest, the entire capital only needs to be repaid on the last due date. This type of loan is often used for second residence or revenue property and is not suitable for everyone.

So with a bullet loan, your rental income can pay off your interest, allowing you to get a full loan. This leverage effect makes for extra high returns.

As a Belgian investor, where is the best place to buy property?

Now that your money is no longer in the company but in your private, there are several investment options.

For example, you could invest in a Belgian property with a generally low return of 2%.

You could also invest in a foreign property, such as in the Netherlands, where there are yields of up to 6%.

In addition, there are several other benefits when investing abroad:

- cheaper property

- additional rental income

- tax advantages

- investment diversification

To help you get off on the right foot in this regard, as an experienced partner, we are happy to help you choose foreign property to maximise your return.

We offer personal and tailor-made advice to help you make your decision. Contact Momo estates for more information.